Proven Guide: Manchester UK House Prices 2025 Info

Introduction

Are you thinking about buying a home in Manchester? Perhaps you are considering selling your current property. Understanding the future of house prices is very important. Manchester’s property market is always changing. It offers exciting chances for many people. This guide will help you understand what to expect. We will look at house prices in Manchester for 2025. You will get clear information and practical advice. This will help you make smart choices.

Manchester is a vibrant and growing city. Its economy is strong. Many people want to live and work here. This demand often affects house prices. We will explore key factors. These factors shape the market. We will also give you a step-by-step plan. This plan will help you navigate the property landscape. Get ready to learn about Manchester’s housing future.

Planning

Planning is key when dealing with property. You need a clear strategy. This is true whether you are buying or selling. The Manchester market has its own unique features. Understanding these features is vital. Good planning helps you avoid problems. It also helps you find the best deals. Think about your goals first. Do you want a family home? Are you looking for an investment property? Your goals will guide your decisions. Research is your best friend in this process. Learn about different areas in Manchester. Each area has its own character. Each area also has different house prices.

Key Considerations

When planning your property journey, several points stand out. These points will help you make informed choices. They are crucial for success in the Manchester property market.

- Market Research is Essential: Always start with deep research. Look at current house prices in Manchester. See how they have changed over time. Understand what drives these changes. Websites and local estate agents can help you. They offer valuable insights into the market. This research gives you a strong base.

- Financial Readiness is Paramount: Know your budget very well. Get pre-approved for a mortgage if you are buying. This shows sellers you are serious. It also helps you understand what you can afford. Consider all costs, not just the purchase price. Legal fees and stamp duty are important.

- Location, Location, Location: Different areas in Manchester have different appeals. Some areas are popular with families. Others attract young professionals. Research schools, transport links, and local amenities. These factors greatly influence property value. They also affect your daily life.

- Future Growth and Development: Look at planned developments in Manchester. New transport links or business parks can boost property values. They can also change the character of an area. Investing in areas with future growth potential is smart. This can lead to better returns.

- Seek Professional Advice: Do not hesitate to talk to experts. Mortgage advisors can help with financing. Estate agents offer market insights. Property solicitors guide you through legal steps. Their knowledge is invaluable. They can save you time and money.

Cost Analysis

Understanding costs is a big part of property decisions. House prices are just one piece of the puzzle. You must consider all related expenses. These include legal fees, surveys, and moving costs. For sellers, there are agent fees and potential repair costs. Being aware of these helps you budget properly. It prevents any nasty surprises later on. The Manchester property market can be competitive. Knowing your financial limits is very important. This allows you to act quickly when the right property appears.

Price Comparison

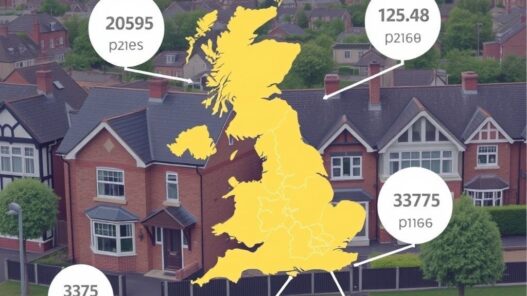

Predicting exact house prices for 2025 is hard. However, we can look at current trends. We can also make educated guesses. Prices vary a lot across Manchester. They depend on property type and location. Here is a general idea of what you might expect. This table shows average price ranges. These are for different property types in Manchester. Remember, these are estimates. Actual prices can differ.

| Property Type | Average Price Range (2024 Estimate) | Projected Average Price Range (2025 Estimate) | Key Factors Influencing Price |

|---|---|---|---|

| 1-Bedroom Apartment | £180,000 – £250,000 | £185,000 – £265,000 | City centre location, modern amenities, transport links. High demand from young professionals. |

| 2-Bedroom Terraced House | £220,000 – £320,000 | £230,000 – £340,000 | Family-friendly areas, access to schools, garden space. Popular in suburban Manchester. |

| 3-Bedroom Semi-Detached House | £300,000 – £450,000 | £315,000 – £475,000 | Larger living space, good schools, quieter neighbourhoods. Strong demand in areas like Didsbury or Chorlton. |

| 4+ Bedroom Detached House | £500,000 – £900,000+ | £525,000 – £950,000+ | Premium locations, larger plots, luxury features. Limited supply in prime Manchester areas. |

These projections consider several factors. These include inflation and interest rates. They also consider supply and demand. Manchester continues to attract investment. This supports a steady increase in house prices. However, market conditions can change quickly. Always get up-to-date information.

Step-by-Step Guide

Navigating the property market can feel overwhelming. This is especially true with fluctuating house prices. A clear, step-by-step approach makes it easier. This guide focuses on practical steps. These steps will help you secure your property in Manchester. Whether you are buying or selling, these instructions are useful. They break down the process into manageable parts. Follow these steps carefully. They will lead you to a successful outcome.

DIY Instructions

These instructions are for anyone engaging with the Manchester property market. They are simple and easy to follow.

1. Define Your Needs and Wants: First, decide what you truly need. Think about the number of bedrooms. Consider the type of property. Do you need a garden? How important is public transport? List your absolute must-haves. Also, list your nice-to-haves. This helps narrow your search.

2. Set a Realistic Budget: Work out exactly how much you can spend. Include the deposit and mortgage payments. Factor in legal fees and stamp duty. Get a mortgage in principle. This shows lenders your borrowing power. It also helps you stay within your financial limits.

3. Research Specific Areas in Manchester: Explore different neighbourhoods. Visit them at different times of day. Look at local amenities. Check school ratings if you have children. Understand the local transport links. Each area in Manchester has its own feel.

4. Engage with Local Estate Agents: Register with several agents. Tell them your specific requirements. They have access to properties not yet advertised. They can also offer valuable local insights. Build a good relationship with them.

5. View Properties Actively: Attend viewings regularly. Take notes and photos. Ask many questions. Do not be afraid to revisit properties. Compare them against your needs list. Think about potential future value.

6. Make an Informed Offer: Once you find the right property, make an offer. Base your offer on your budget. Also, consider the current house prices in the area. Be prepared to negotiate. Your estate agent can help with this.

7. Secure Your Mortgage and Solicitor: After an offer is accepted, finalize your mortgage. Appoint a reliable property solicitor. They will handle all legal aspects. This includes searches and contracts. They ensure a smooth transaction.

8. Arrange Surveys and Inspections: Get a property survey done. This checks for any structural issues. It can save you from costly repairs later. Also, arrange any necessary inspections. This might include gas or electrical checks.

9. Exchange Contracts and Complete: Your solicitor will guide you through this. Exchange contracts means the deal is legally binding. Completion is when you get the keys. This is the exciting final step.

Maintenance Tips

Owning a property is a long-term commitment. It is not just about buying it. You also need to maintain its value. This is crucial for future house prices. Good maintenance protects your investment. It also makes your home a better place to live. Regular care prevents small problems from becoming big ones. It can save you a lot of money in the long run. These tips focus on keeping your property in top condition. They help ensure its value remains strong in Manchester.

Long-Term Care

Taking care of your home is vital. These tips will help you maintain its value. They will also keep it comfortable.

- Regular Property Inspections: Walk around your home often. Look for signs of wear and tear. Check the roof, gutters, and exterior walls. Early detection of issues saves money. It prevents major damage.

- Address Repairs Promptly: Do not delay fixing problems. A leaky tap can lead to damp. A small crack can become a big one. Quick repairs maintain the property’s integrity. They also keep its value high.

- Invest in Smart Upgrades: Consider upgrades that add value. A new kitchen or bathroom can boost appeal. Energy-efficient improvements are also smart. These can include better insulation or new windows. They make your home more attractive.

- Maintain Your Garden and Exterior: Kerb appeal is very important. Keep your garden tidy. Paint your front door. Clean your windows regularly. A well-maintained exterior makes a great first impression. This can positively impact house prices.

- Keep Records of All Work: Document all repairs and renovations. Keep receipts and warranties. This information is useful for future sales. It shows potential buyers the care you have taken. It also helps with insurance claims.

Conclusion

Understanding house prices in Manchester for 2025 is a journey. It requires careful planning and research. The city’s property market is dynamic. It offers many opportunities for buyers and sellers. We have explored key considerations. We looked at cost analysis and practical steps. We also discussed long-term maintenance. Remember, knowledge is power in real estate.

Always stay informed about market trends. Seek professional advice when needed. Be prepared for negotiations. By following this guide, you are well-equipped. You can make confident decisions. Manchester’s property market is exciting. With the right approach, you can achieve your property goals. Your future in Manchester starts now.