Best Guide: Important House Prices UK 2024

Introduction

Understanding current house prices is very important. Many people want to buy or sell a home. Knowing the market helps you make smart choices. This guide will help you understand UK house prices in 2024. We will look at key factors affecting the market. We will also provide practical advice for buyers and sellers. The housing market is always changing. Staying informed is key to success. This article offers clear, simple information. It covers everything you need to know. Get ready to explore the world of UK property.

The UK housing market faces new challenges. Interest rates are a big factor. Inflation also plays a role. Many people wonder about future house prices. This guide aims to answer those questions. We will break down complex ideas. Our goal is to make it easy to understand. You will learn about market trends. You will also get tips for your property journey. This information is vital for everyone. It helps first-time buyers. It also helps experienced investors. Prepare to gain valuable insights. Your property decisions will be better informed.

The year 2024 brings unique conditions. Economic forecasts influence buyer confidence. Government policies also have an impact. We will explore these elements in detail. Our focus is on practical knowledge. This guide is your go-to resource. It simplifies the complexities of house prices. You will feel more confident. You will be ready to navigate the market. Let’s dive into the specifics. Discover what 2024 holds for UK property.

Planning

Careful planning is essential for any property move. It helps you avoid common pitfalls. Good preparation saves you time and money. Consider all aspects before you act. This section outlines key points. These points will guide your decisions. They apply whether you are buying or selling. Understanding the market is the first step. Knowing your financial limits is another. Think about your long-term goals. This strategic approach pays off. It leads to better outcomes. Let’s look at the important considerations.

Key Considerations

- Market Trends: Watch how house prices are moving. Are they rising, falling, or staying flat? Current trends affect property values. This information helps you time your move. It shows if it is a buyer’s or seller’s market.

- Interest Rates: Higher interest rates mean more expensive mortgages. This can reduce what people can afford. Keep an eye on Bank of England announcements. They directly impact borrowing costs. Mortgage rates affect demand for homes.

- Economic Outlook: A strong economy often supports higher house prices. Job security and wage growth matter. A weaker economy can slow the market. Understand the broader economic picture. This helps predict market stability.

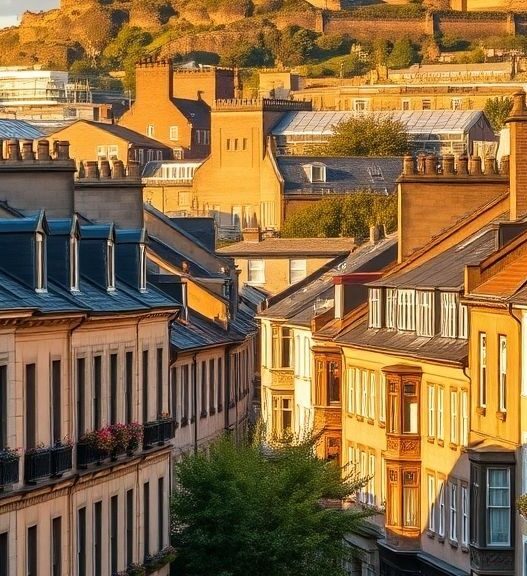

- Regional Variations: House prices differ greatly across the UK. London prices are often much higher. Northern regions might offer better value. Research specific areas you are interested in. Local market conditions are very important.

- Personal Financial Situation: Assess your own budget carefully. Know how much you can afford to borrow. Consider all costs, not just the purchase price. This includes stamp duty and legal fees. Be realistic about your finances.

Each of these factors plays a crucial role. They influence the overall market. They also affect individual property values. Taking time to understand them is wise. It prepares you for potential changes. This proactive approach is beneficial. It helps you make informed choices. Your property journey will be smoother. Always review these points regularly. The market can shift quickly. Stay updated for the best results.

Cost Analysis

Understanding the costs involved is critical. This goes beyond just the asking price. There are many associated expenses. These include legal fees and taxes. Mortgage arrangement fees also add up. A full cost analysis prevents surprises. It helps you budget accurately. This section provides a price comparison. It shows average house prices across different UK regions. This data gives you a clear picture. It highlights regional disparities. Use this information wisely. It helps you set realistic expectations. Let’s examine the numbers closely.

Price Comparison

Average house prices vary significantly across the UK. These figures are estimates for 2024. They show the general trend. Actual prices depend on specific properties. Location within a region also matters. This table provides a useful overview. It helps compare different areas. The data reflects market conditions. It shows how house prices have changed. Use this as a guide for your research.

| Region | Average Price (2023) | Average Price (2024 Est.) | Change (%) |

|---|---|---|---|

| London | £515,000 | £505,000 | -1.9% |

| South East | £380,000 | £375,000 | -1.3% |

| North West | £210,000 | £215,000 | +2.4% |

| Scotland | £195,000 | £200,000 | +2.6% |

| Wales | £215,000 | £218,000 | +1.4% |

| West Midlands | £250,000 | £252,000 | +0.8% |

| East of England | £350,000 | £345,000 | -1.4% |

The table shows varied trends for house prices. Some regions like London saw a slight decrease. Others, like the North West, experienced growth. This highlights the diverse nature of the UK market. Factors like supply and demand play a big role. Local economic conditions also influence these figures. Always check current data for your specific area. These averages provide a starting point. They help you understand the broader picture. Remember that house prices are dynamic. They can change throughout the year. Stay updated with market reports. This ensures you have the latest information.

Beyond the purchase price, consider other costs. Stamp Duty Land Tax (SDLT) is a major expense. Legal fees for solicitors are also necessary. Valuation fees and survey costs add up. Mortgage arrangement fees can be significant. Removal costs should also be budgeted. Factor in potential renovation expenses. These additional costs can be substantial. They can add thousands to your total outlay. Always get detailed quotes for everything. This helps you create a realistic budget. Do not overlook these hidden expenses. They are a crucial part of the cost analysis. Proper budgeting prevents financial strain. It makes your property journey smoother. Be prepared for all financial aspects. This comprehensive approach is best.

Step-by-Step Guide

Buying a home is a significant life event. It involves several distinct stages. Following a clear process helps immensely. This guide breaks down the steps. It makes the journey less daunting. Each step is important for success. Take your time with each phase. Do not rush any decisions. This detailed approach ensures you are prepared. It helps you navigate the complexities. From initial research to moving in, we cover it all. This section provides practical, actionable advice. It simplifies the home-buying process. Let’s walk through it together. Your dream home awaits.

DIY Instructions

These steps apply to most home purchases. They are designed to be easy to follow. Each instruction is clear and concise. This helps you stay organized. It ensures you do not miss anything important. Follow these steps for a smooth process. They will guide you effectively.

- Research the Market: Start by looking at house prices. Use online property portals. Check local estate agent listings. Understand what homes are selling for. Look at different property types. Research areas you like. Consider schools and transport links. This initial research is vital. It sets your expectations.

- Get Your Finances in Order: Determine your budget first. Speak to a mortgage advisor. Get an Agreement in Principle (AIP). This shows how much you can borrow. Save for your deposit and other costs. Check your credit score. Improve it if needed. This step is crucial. It confirms your buying power.

- Find a Property: Start viewing homes that fit your criteria. Attend open houses. Arrange private viewings. Take notes on each property. Consider its condition and location. Think about future potential. Do not rush this process. Find a home you truly love.

- Make an Offer: Once you find a home, make an offer. Your estate agent will help you. The offer should be realistic. It should reflect market house prices. Be prepared for negotiation. The seller might counter-offer. Agree on a price you are happy with.

- Secure Your Mortgage: Apply for your full mortgage. Provide all required documents. The lender will value the property. They will check its suitability. This process can take time. Be patient and responsive.

- Appoint a Solicitor: You need a solicitor for legal work. They handle conveyancing. They check property deeds. They manage contracts and searches. Choose a solicitor carefully. Good communication is key.

- Arrange Surveys: Get a property survey done. This checks the home’s condition. It can reveal hidden problems. There are different types of surveys. Choose one appropriate for the property. This protects your investment.

- Exchange Contracts: This is a major legal step. Both parties sign the contract. Your deposit is paid. The sale becomes legally binding. You cannot pull out without penalty. A completion date is set.

- Complete the Purchase: On completion day, funds are transferred. The solicitor registers the new ownership. You receive the keys to your new home. This is the exciting final step. You are now a homeowner.

- Move In: Plan your moving day carefully. Arrange for removals. Inform utility companies. Update your address everywhere. Settle into your new home. Enjoy your new space.

Each of these steps requires attention. They build upon one another. Following them systematically helps. It reduces stress and confusion. Remember that house prices can influence offers. Always be informed about the market. This guide provides a clear roadmap. It helps you achieve your homeownership goals. Be thorough and patient. Your efforts will be rewarded.

Maintenance Tips

Owning a home is a big responsibility. Proper maintenance keeps your home safe. It also protects its value. Regular care prevents major problems. It saves you money in the long run. Neglecting small issues can lead to big repairs. This section offers practical tips. These tips help you maintain your property. They ensure your home remains a valuable asset. Good maintenance extends your home’s lifespan. It also enhances your living comfort. Let’s look at how to care for your investment. These simple steps make a big difference.

Long-Term Care

- Regular Inspections: Walk around your home often. Look for cracks, leaks, or damage. Check the roof, gutters, and foundations. Early detection saves costly repairs. Schedule professional inspections too.

- Budget for Repairs: Set aside money for maintenance. Unexpected issues can arise. Having a repair fund is smart. This prevents financial stress. It ensures you can fix problems quickly.

- Keep Up with Minor Fixes: Do not ignore small issues. A dripping tap wastes water. A loose tile can cause bigger damage. Address these problems promptly. Small fixes prevent major headaches.

- Maintain the Garden: A well-kept garden adds curb appeal. It also prevents structural issues. Trim trees and bushes regularly. Clear drains and pathways. A tidy garden enhances your home.

- Insure Your Home Properly: Have adequate home insurance. This protects against unforeseen events. Review your policy annually. Ensure it covers current house prices. This provides peace of mind.